Our Stories

Our Stories

Welcome back to Re:Access, a newsletter series by Samsung Bioepis that Rethinks biosimilars as the answer to future healthcare Access.

In our fourth issue, we take a moment to address all stakeholders in the biosimilar ecosystem. What role do stakeholders play in driving biosimilar adoption and shaping the future of healthcare access?

Every Stakeholder Must Act to Fill the Biosimilar Void

The biosimilar void has been frequently discussed but never visualized—until now. Our new video finally puts shape to the problem, showing what the void is, how it impacts patients and markets, and what can be done to address it.

As we state at the end of the video, we’re calling for all stakeholders to tackle this gap in biosimilars that are in development for biologics losing exclusivity over the next decade.

Biosimilars are vital to sustaining healthcare systems and increasing access to innovative treatments. We risk losing these benefits if those who shape the biosimilar ecosystem – regulators, payers, physicians, manufacturers and patients – fail to coordinate driving biosimilar adoption globally.

It will take the collective effort of all stakeholders to course correct.

Policymakers: Setting the Right Framework

Let’s start with the market entry environment.

While we have seen meaningful progress in biosimilar regulation, we still have much work ahead.

Out of 28 European countries, 17 countries mandate arbitrary discounts on biosimilar prices at an average of 28% below the reference product, creating an unlevel playing field. Cost-containment policies can reduce a biosimilar’s market viability further, leading to a “race-to-the-bottom price erosion” dynamic.

This pricing framework is especially harmful because biosimilars are, fundamentally speaking, a different business model from the existing biologic product market. As Gillian Woollett, VP and Head of Regulatory Strategy and Policy at Samsung Bioepis, puts it: “By its very nature, the off-patent industry is designed to bring cost efficiencies and value to payers, healthcare providers, and patients once patents have expired on their branded reference products. Generics and biosimilars are already operating their manufacturing and supply chains to maximum efficiency with very thin margins.”

To encourage market participation, policymakers must help adjust cost-containment measures that aren’t sustainable for biosimilars, such as clawbacks, paybacks or rebates. For instance, the UK’s improvements to their clawback policies for biosimilars mark a move in the right direction.

Policymakers should rectify certain pricing policies and other processes that aren’t working in the context of biosimilars. More supportive frameworks that help protect the long-term profitability of biosimilar manufacturing are needed.

Physicians and Patients: Resolving Gaps in Trust

Past the market entry hurdles, however, biosimilars still face trust gaps among key stakeholders – namely, physicians and patients.

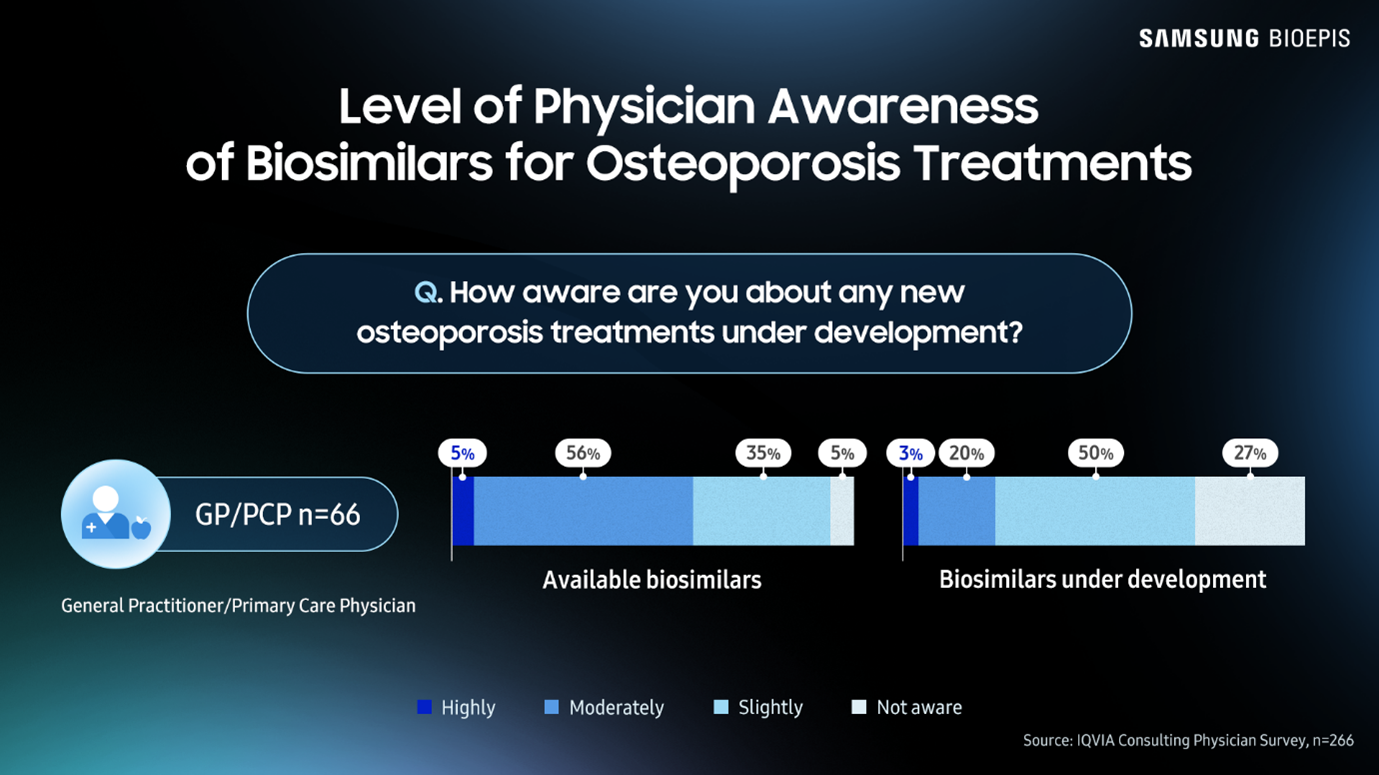

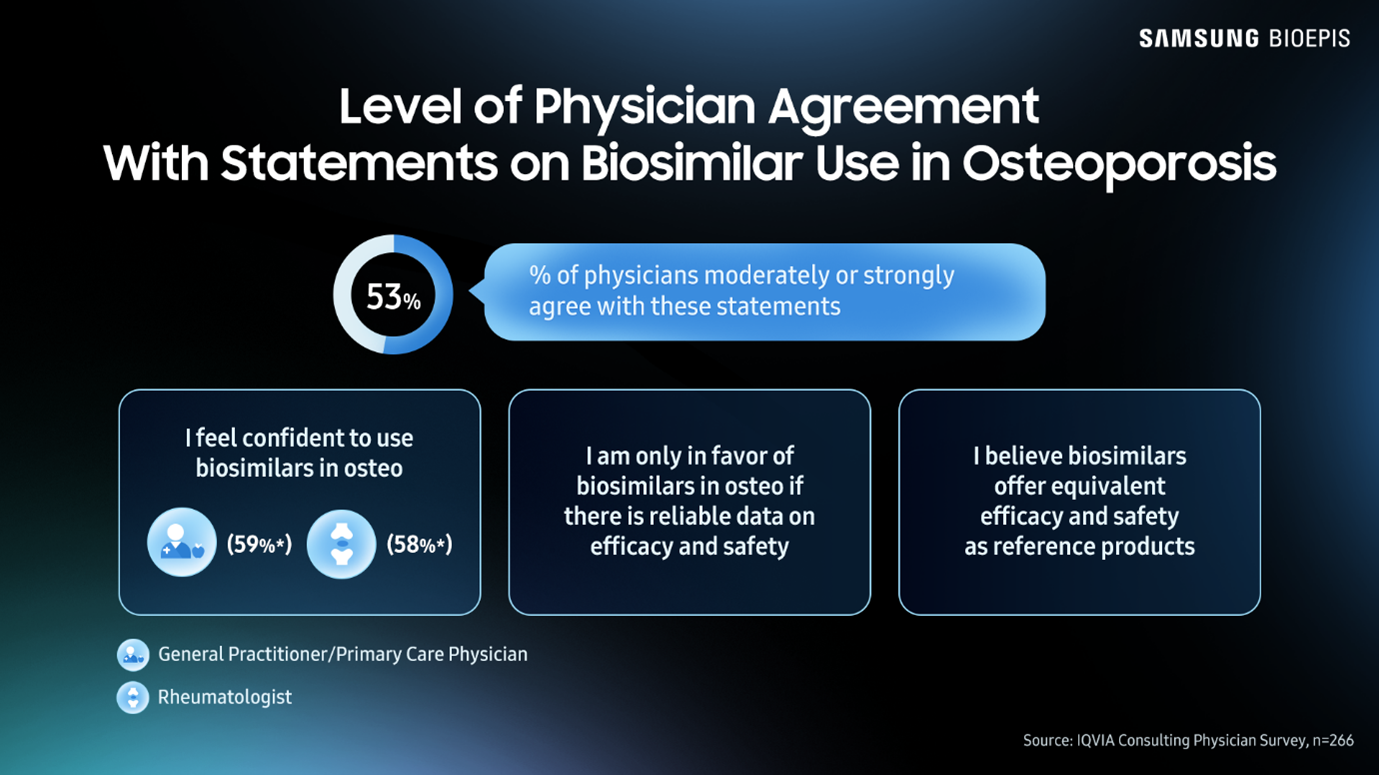

According to the IQVIA Institute Report: Unlocking Biosimilar Potential, May 2025, a case study on osteoporosis treatments showed that awareness of and confidence in current and future biosimilars was very low among some physician groups. Only 3% of general practitioners and primary care physicians (GPs and PCPs) were “highly aware” of biosimilars in development. Approximately only 56% of rheumatologists, orthopedists, obstetricians/gynecologists and GPs/PCPs could say they strongly agree with the statement, “I feel confident to use biosimilars in osteoporosis.”

These findings show a distinct lack of understanding regarding biosimilars among physicians. How can patients be confident in taking biosimilars if physicians aren’t confident in prescribing them?

The same report noted that over 60% of physicians identify treatment guidelines, medical societies and conferences, and medical journals as key sources of information that influence their treatment decisions involving biosimilars.

Updating authoritative treatment guidelines to explicitly include biosimilars as well as leveraging medical societies and scholarly publications will encourage biosimilar adoption among healthcare professionals, which will ultimately benefit patients.

Manufacturers: Boosting Confidence Through Quality and Education

To address the gaps in awareness among all stakeholders, manufacturers should strongly support educational initiatives. This will strengthen general confidence in the scientific basis underpinning biosimilar production and approval processes, eliminating misunderstandings that biosimilars aren’t as efficacious or safe as their reference products.

The cultivation of trust in biosimilars also depends on manufacturing standards. Building meaningful global partnerships and maintaining high-quality standards in sourcing, production and distribution are crucial for biosimilar manufacturers. By consistently ensuring quality-assured biosimilar medicines are entering the market, manufacturers will naturally foster trust in biosimilar products.

Riding the Momentum

All stakeholders benefit from biosimilars thriving – greater resources in innovation, increased patient therapy days, enhanced supply surety, and more – so there’s no reason not to act.

“Everybody should always ask the question: is there a biosimilar available?” Tom Newcomer, VP and Head of US Commercial Operations at Samsung Bioepis, points out. “No matter who you are in the chain, it's going to reduce healthcare costs for everybody.”

Biosimilars are already delivering significant cost-savings for global healthcare systems, but their full potential may be lost to the void if we do not act now. It’s time for all stakeholders to ride the momentum generated this year through further approvals and regulatory streamlining, and close the looming biosimilar void.

References:

● AAM. 2025 U.S. Generic & Biosimilar Medicines Savings Report. September 2025. Accessible at: https://accessiblemeds.org/resources/reports/2025-savings-report/

● IQVIA Institute. Unlocking Biosimilar Potential: Learnings from an Osteoporosis Case Study of Complex Patient Pathways. May 2025. Available at: https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/unlocking-biosimilar-potential-2025

● Interview Transcript. Bioworld Interview. Tom Newcomer, VP, Head of US Commercial Operations, Samsung Bioepis. July 2025.

● Biosimilars in US Healthcare Adoption, Opportunities, and Outcomes. Reuters Events Webinar Transcript. Tom Newcomer, VP, Head of US Commercial Operations, Samsung Bioepis. October 2025.

● Onshoring Could Threaten the Resilient Supply Chain for Biosimilars and Generics. STAT+ Op-ed. Gillian Woollet, VP, Head of Regulatory Strategy and Policy, Samsung Bioepis. October 2025.

● The Biosimilar Medicines Group. Market Review – European Biosimilar Medicine Markets 2023. Available at: https://www.medicinesforeurope.com/wp-content/uploads/2023/09/Biosimilars-Market-Review-2023-final-06-09-2023.pdf

● 2024 voluntary scheme for branded medicines pricing, access and growth: summary of the heads of agreement. November 2023. Available at: https://www.gov.uk/government/publications/2024-voluntary-scheme-for-branded-medicines-pricing-access-and-growth-summary-of-the-heads-of-agreement/2024-voluntary-scheme-for-branded-medicines-pricing-access-and-growth-summary-of-the-heads-of-agreement